What is the situation/progress with the proposed hotels in Kruger?

- Mel

- Global Moderator

- Posts: 28237

- Joined: Sat May 19, 2012 12:31 pm

- Country: Germany

- Location: Föhr

- Contact:

Re: What is the situation/progress with the proposed hotels?

Thanks for your dedication, H.e.!

God put me on earth to accomplish a certain amount of things. Right now I'm so far behind that I'll never die.

Re: What is the situation/progress with the proposed hotels?

Here an overview with some interesting data

23 August 2012: The development of RADISSON BLU SAFARI RESORT, KRUGER PARK for MALELANE SAFARI RESORT INVESTMENTS (PTY) LTD Prepared by Secprop

23 August 2012: The development of RADISSON BLU SAFARI RESORT, KRUGER PARK for MALELANE SAFARI RESORT INVESTMENTS (PTY) LTD Prepared by Secprop

EXECUTIVE SUMMARY

Kruger National Park (KNP) is the leading tourist attraction in South Africa and covers an area of almost 20,000 square kilometres. It is unrivalled in the diversity of its life forms and is truly the flagship of the 19 South African national parks, being home to an impressive number of species, among them the “Big Five” mammals. The southern section of the Park is by far the most popular among tourists because of its easy access from Johannesburg and Pretoria and its proximity to the Kruger Mpumalanga International Airport.

In January 2010, the Company was awarded a 30 year Concession by South African National Parks (SANParks) to build the 240bed 4-star Radisson Blu Safari Resort, Kruger Park (the Resort) inside the KNP on the southern border along the Crocodile River near Malelane Gate. The process is well under way and construction is due to commence around February 2013, for an estimated date of occupation in March 2014. The Carlson Rezidor Hotel Group have signed an International Management Agreement to operate the resort for the first 20 years.

This is a unique opportunity to develop a product for which a large gap and demand exists in the market. Presently no competitive large-scale 4-star accommodation exists within the KNP. All current accommodation is either high-volume, low-priced for the mid- to low-end self-catering market, or alternatively low-volume, high-priced for the high-end fully-catered market. In addition, no recognized international management company has a presence in the KNP to provide world-class service to a large market at an affordable price.

The need for a resort within the KNP was conceived at the highest level of the Government of South Africa, as it will be the flagship product of the Tourism Industry, which has been identified as one of the 6 major industries for the Government’s Economic Growth Plan. The Resort complies ideally with this Plan, as it is situated in a rural area, and will greatly benefit a Community that is in desperate need of socio-economic upliftment. Opportunities for employment and the growth of Small Micro and Medium Enterprise (SMME) businesses will be a direct consequence of the business, supporting the principles of Responsible Tourism.

The Company has identified a number of policies relating to the appointment of Black persons as managers and directors of the Company and has adopted a policy of preferential employment from within the local area of all employees, other than in key skilled areas, both for construction and implementation stages. In addition, in conjunction with an institution that is committed to the development of Small, Medium and Micro Enterprises in the rural areas, the Company will acquire supplies and services from within the local economy.

A Community Trust has been formed that will own a minimum of 10% of the equity of the business. This Trust is to be funded by an institutional funder that specializes in this field. This Trust will provide financial benefits to the 18 villages that are identified by SANParks as representative of the adjacent

Community.

After an extensive selection campaign, 22 youths from the defined area were granted bursaries for hospitality and nature guide training. Twelve hospitality students are currently undergoing training at the SA College for Tourism in Graaff-Reinett, and ten nature guiding students are at the Southern

African Wildlife College in Hoedspruit,

The Resort is planned to open in the early part of 2013, which is forecast to be good timing by industry experts. According to the PricewaterhouseCoopers South African Hospitality Survey, dated July 2011, a rebound is on the cards for SA’s accommodation industry. Report findings state (Source:

South African hospitality outlook: 2011–2015 – http://www.pwc.com/za/en/publications/h ... ityoutlook. jhtml):

· The accommodation sector will see good returns into the medium term future, but these will be lower than experienced in the past.

· Following a medium-term trough in 2011, occupancy rates for hotels should begin to increase. Beginning 2013, demand for rooms will again grow faster than supply, and the overall occupancy rate will begin to increase, to reach a forecast average 48,5% in 2015.

· The average room cost across all grades of accommodation in 2015 will achieve a compound increase of 5,1% annually from 2011.

· Total room revenue is expected to reach R 17.6 billion in 2015, an 8,1% compound annual increase from 2011’s expected R 12.9 billion.

Overview of the Project

1. The Secprop Leisure Consortium (“SLC”) responded to a formal Tender that was conducted by South African National Parks (“SANParks”) in July 2009. The tender was awarded to SLC on January 20, 2010. By signing the Public Private Partnership (PPP) Agreement, SLC has agreed with SANParks to facilitate the conceptualisation, design, funding, construction and operation of the business.

2. The Strategic Objective of SLC is to compete in the wildlife tourism market by constructing resorts with a relatively high volume of beds, which are operated and marketed by international hospitality companies with extensive market reach and which offer exceptional guest experiences at an affordable price to the business, foreign tourist and domestic family markets. Included is a strong commitment to local communities, responsible tourism, and green design and operation.

3. Malelane Safari Resort Investments (Pty.) Ltd. (“MSRI”) is a Special Purpose Vehicle company formed as a result of a PPP Agreement entered into between the Company and SANParks. The business objective is to design, construct and operate a Resort in the KNP for a period of 30 years. The rights granted by the PPP Agreement were ceded to MSRI on December 13, 2010.

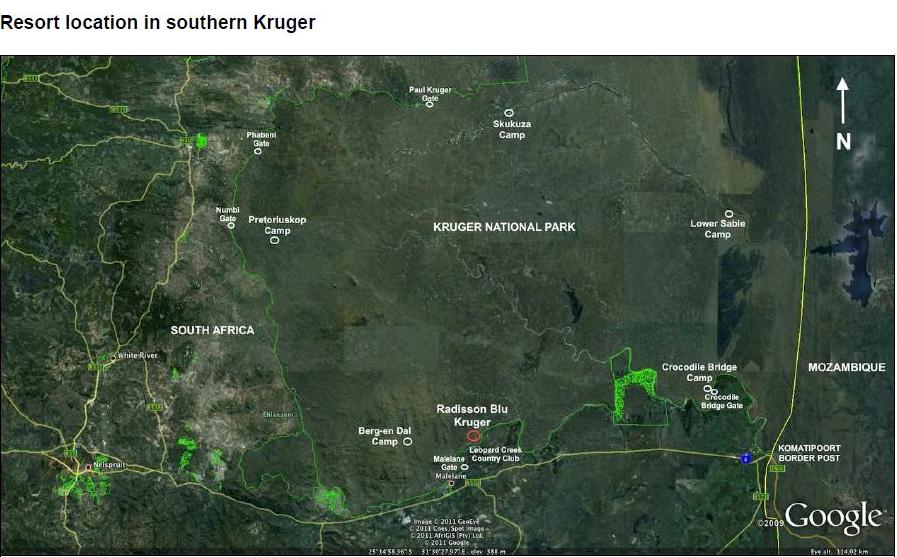

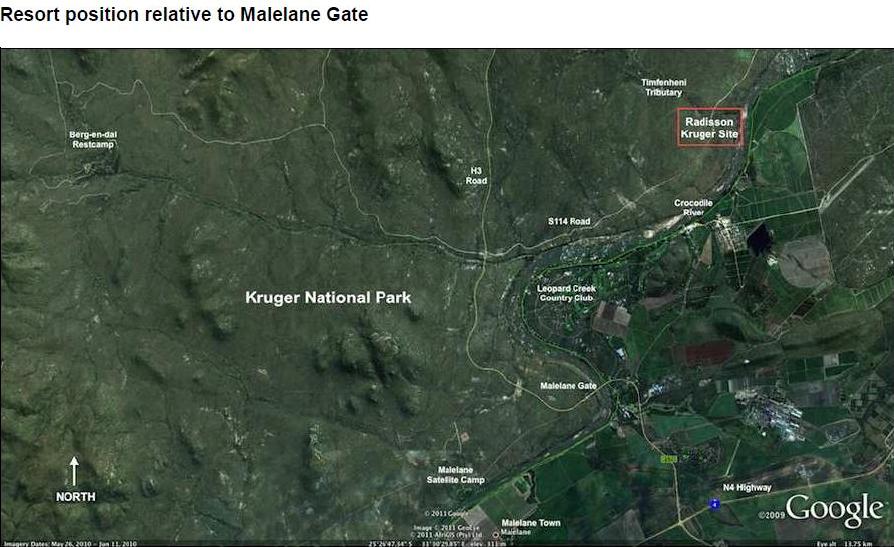

4. The Resort is located within the KNP near the Malelane Gate. It lies within 4.5 hours drive by road from Johannesburg and Pretoria and 40 minute drive from Nelspruit and Kruger Mpumalanga International Airport. It is situated in the province of Mpumalanga, which is one of the most attractive tourism destinations in South Africa, and within 2 hours drive of Maputo and the Mocambique coast.

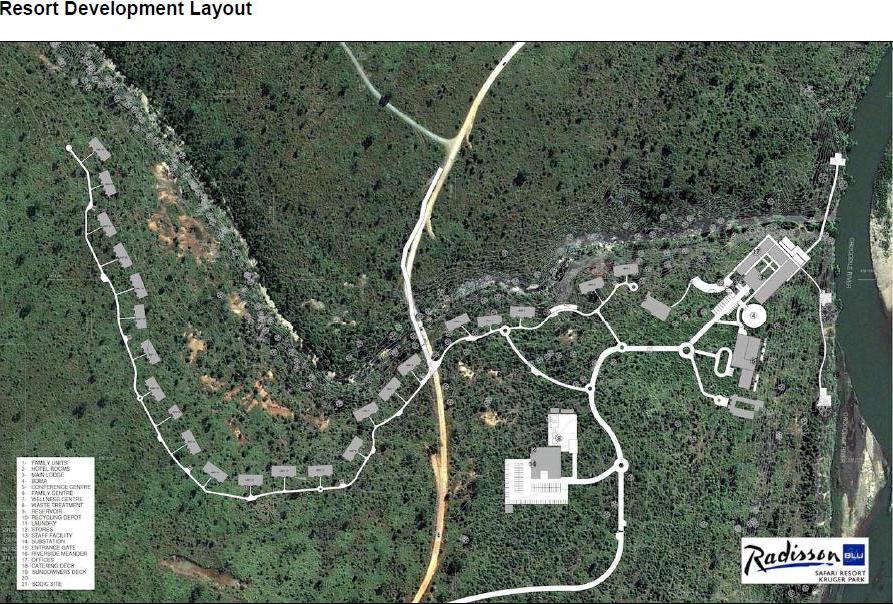

5. Given the choice of 5 sites, a site at the confluence of the Crocodile River and the Timfenheni Tributary was selected – a distance of 10 kms into the Park from the Malelane Gate. The gate lies adjacent to the leading lifestyle estate and golf course in the country, Leopard Creek Country Club.

6. The Resort is restricted to 240 beds and comprises:

· Accommodation: 111 x 2 bed standard hotel rooms and 4 x 4 bed family suites

· Main Lodge Complex - consisting of lounge, dining area, patio, pool deck, kitchen, management offices and reception area

· Conference Centre

· Wellness Centre

· Family Centre

· Staff Facility and Services – waste treatment, reservoir, recycling depot, laundry, stores, sub-station and GM house

· Viewing decks and a suspension bridge at strategic locations

· Maids rooms

· Gatehouse

· Welcome Centre at the Park & Ride situated at Malelane Gate.

7. In keeping with the Resort’s commitment to limit the traffic in the southern area of the Park, guests are required to park their vehicles at a Welcome Centre, which is situated at the entrance to the Park at the Malelane Gate. They will then be transported to the Resort, which provides an ideal opportunity for an introduction to the wildlife experience. The Welcome Centre will also cater for SANParks’ new policy to institute a Park and Ride system for public day visitors.

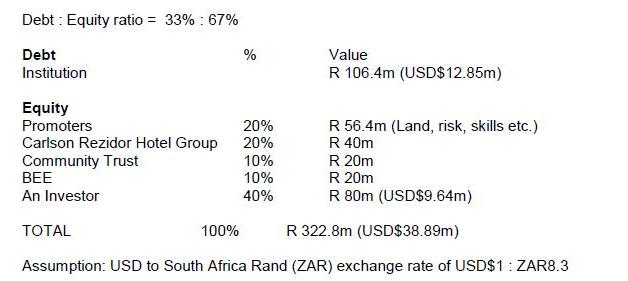

8. Project Funding and Shareholding – Secprop Leisure, in conjunction with Cradle, are the promoters of the opportunity and will own 20% of the Company, without further funding commitment. Secprop Leisure are also the appointed Development Managers for the project. The Carlson Rezidor Hotel Group will also own a 20% shareholding stake in the Company. Equity funding will be provided by a South African institution in respect of 10% share to be owned by the local Community around Malelane. A minimum of 10% will be owned by a Black Economic Empowerment (BEE) partner.

The most appropriate debt to equity ratio should be at most 40% debt funding and 60% equity funding. The Company is in negotiations with funding institutions for both the debt and equity components.

An investment opportunity therefore exists for an Investor to obtain a minimum 40% shareholding in the project for R 80 million (USD$9.64m). However, a greater equity share can be negotiated should the Investor wish to purchase the Promoters 20% share.

Once the equity and shareholding is in place, the development funding institutions can be approached to provide the debt funding.

9. Financial Forecasts – All forecasts are based on a number of assumptions that attempt to predict the future. They are also reliant on the actual structuring of the business and the performance of management as being in unison with that forecast. Therefore the financial forecast can only be regarded as a best estimate of the likely financial outcomes and should not be relied upon for investment decisions.

· Fixed Assets

Fixed Assets are forecast to amount to R322.8 million. It is hoped that considerable value engineering will substantially reduce this figure, but the professionals will only re-commence once the funding has been received. The land consists of leasehold premises for the duration of 30 years, whereupon the land plus buildings thereon will revert to the SANParks. The value of the Concession has been contributed in the form of equity by the Promoters and is calculated at R56.4 million, inclusive of the work done by the Promoters to bring the land to a point near to Bankable Feasibility. The cost of construction is estimated by the QS at R245 million, with the movable assets expected to be R22 million. Project start up requirements have been budgeted at R13 million. All figures are exclusive of VAT.

· Equity and Debt Funding

The debt : equity ratio is 33:67, thereby enabling a gearing that will provide the project with every chance of success, although a higher equity ratio will be welcome. All equity, amounting to R160 million, is to be contributed in the form of unencumbered equity, with no interest or expectation of a prescribed return on investment. Equity contributors will be expected to provide an upfront amount before Bankable Feasibility can be finalised, amounting to a total of R1 million to bring the EIA and the marketing study to completion. Thereafter, the equity funding will be contributed over the construction period, to be followed by the interest bearing debt of R106.4 million. Interest is expected to be at prime, currently 9.5% in South Africa, and has been modelled on a two-year interest payment holiday, with an effective repayment term of 14 years.

· Profitability

The project qualifies for Government Grant funding under the Enterprise Investment Programme, amounting to a cash reimbursement over two years of R30 million. This has been taken into account for the project operating income, after extending the forecast as provided by Carlson Rezidor Hotels. As a result, the forecasts indicate profitability in year 1, although the actual operating profitability, after interest and taxation, is only achieved in year 2. One of the main reasons for attractive profitability is because of high anticipated occupancies, commencing at 45% in year 1, based on the actual achieved occupancies of the southern selfcatering, self-drive camps of the Kruger Park, which are experienced occupancy rates of between 72% and 84% for the year ended April 2012. It is important to note that the profitability forecast is provisional as it is subject to the completion of a full marketing and financial assessment by an independent specialist consultant.

· IRR

The after tax cash flows, benefiting from favourable interest and loan repayment terms, as well as the above grant funding, indicate an IRR of 25% to be achieved before the end of year 7. The IRR improves once the loan is fully repaid in year 14 and reaches 38% towards the end of the lease in year 25.

10. International Operator (Managing Agent) – A key to the success of the business venture is the inclusion of the Carlson Rezidor Hotel Group as a shareholder and its appointment as hotel operator under an International Management Agreement. The resort will be branded as Radisson Blu Safari Resort Kruger Park. Carlson Rezidor has been selected due to its significant business segment hotel presence in Southern Africa.

Carlson Rezidor has made a strategic decision to invest extensively in Africa, with 30% of the investment to be in leisure hotels, concentrating on a “beach & bush theme”. They are expanding into Southern Africa faster than any other international operator, with 12 hotels by 2013. Rezidor has been in Africa since 1999, when they opened the Radisson Blu Hotel Waterfront in Cape Town, and today has the largest pipeline of internationally branded hotel rooms in sub-Saharan Africa.

Carlson Rezidor are the 9th largest hotel company in the world with USD 7 billion system-wide revenues. Their global portfolio includes more than 1,319 hotels and 209,000 rooms in operation and under development in 80 countries, and employs more than 80,000 people. The marketing strategy for the Resort will be devised by Carlson Rezidor, who have global marketing reach and a fantastic loyalty programme in Carlson Plus.

11. The project has been in the planning stages for the past two and a half years and is already well into the design phase. Progress to date is as follows:

· PPP Agreement signed on February 17, 2010 for commencement date of March 1, 2010.

· Initial site land surveys completed July 1, 2010.

· Environmental Impact Assessment (EIA) commenced July 15, 2010, with contributions from a number of specialist consultants. The Department of Environmental Affairs has sent a reaction to the Final Scoping Report and the EIA Consultants to their requirements by amending and resubmitting the Final Scoping Report in April 2012. The Report was received without any negative comment of consequence and the final Environmental Impact Assessment process in underway. The process is due for completion in January 2013.

· The site layout plan has been completed and allows for “no go zones” to cater for the presence of a “Red Data” plant species on the site, the Swazi Lily.

· Carlson Rezidor were appointed as the Resort operators as per the International Management Agreement dated October 28, 2010.

· Design has been agreed upon, after considerable input from the Technical Services department of Carlson Rezidor. The design of the interiors and finishings has been completed by the interior architects, Source, in accordance with the Radisson technical specifications.

· In order to provide the information necessary for the completion of the EIA and to enable the cost estimation, the international engineering firm of WSP has provided engineering input and drawings for various aspects, including roads, sewerage, waste management, structural and civil engineering, water supply, electrical infrastructure, electronics and “green building techniques”.

· After an initial value engineering exercise, using the design and the engineering specifications, the company’s Quantity Surveyors, Turner & Townsend, have estimated the cost of the project at R 245 million (excluding VAT). To this must be added the moveable assets, costing R 22 million (ex. VAT), and the cost of the opening budget and working capital, totalling R 13 million (ex. VAT). The total cost is therefore estimated to be R 280 million (ex. VAT).

· Further value engineering is required to reduce this amount to no more than R 238 million in total, in order to reduce the cost per room to R 2 million, which is a benchmark figure for a hotel of this standard, although some allowance needs to be made for the remote location. This exercise will be conducted with the appointed building contractor.

· In order to comply with the requirements of the tender regarding “Green Building” a light-weight building system has been proposed that will provide significant green benefits and reduce both building and operational costs.

· Combined with the promoter equity of R 55.8 million (includes capital, sweat equity and value of the land), the total project value is estimated at R 322.8 million (USD$ 38.9 million).

12. Project Development Team

Developers: Malelane Safari Resort Investments

Land Custodians: South African National Parks

Hospitality Operator: Carlson Rezidor Hotel Group

Guest Experience Operator: Wild Safari Experiences

Primary Funder: To be confirmed

Attorneys: Bartletts Incorporated

Company Secretaries: J Murray & Chamberlain

Risk Management: Alexander Forbes

Professional Team:

· Development Manager: Secprop Leisure

· Project Manager: John Deeb Projects

· Building Contractor: G D Irons Construction

· Architect: Cronje Associated Architects

· Quantity Surveyor: Turner & Townsend

· Engineers: WSP Group

· Health & Safety: WSP Group

· Geo-technical & Geo-hydrological: WSM Leshika Consulting

· Interior Design: Source Interior Brand Architects

· Land Surveyor: Urban Dynamics Land Surveyor

· Environmental Impact Assessor: V&L Landscape Architects

· Environmental Control Officer: Shinzele Safaris

· Ecologist: Ecorex Consulting Ecologists

· Heritage Impact Assessor: JA van Schalkwyk

· Visual Impact Assessor: i-Scape Landscape Design & Environmental Consulting

13. Project Timing – Construction on the Resort is expected to commence approximately February 2013 and to be completed for opening by latest April 2014.

14. The Promoters have advanced this project to the early part of Stage 3: Bankable Feasibility, by conducting the following:

· Tender

· Pre-tender process

· Conceptualisation

· Research

· Tender

· Signing of PPP Agreement

· Business Set-up

· Contract negotiation and appointment of Carlson Rezidor

· Legal

o Company statutory documents

o Carlson Rezidor International Management Agreement

o Draft shareholder agreements

o NCND agreements

o Community trust deed

· Business structuring

o Business plan and basic market assessment

o Financial feasibility forecast

o Equity and loan funding applications

o Appointment of professional team

o Community meetings

o Contractor – Tender adjudication and stage 2 negotiation

o Vehicle and game viewing business establishment

· Environmental

· Environmental impact assessment – second submission for Amended Scoping Report

· Six focus group meetings held with Interested & Affected Parties

· Waste management plan

· Terrestrial ecological assessment

· Geotechnical and hydrogeological assessment

· Heritage impact assessment

· Design & Planning

· Land survey

· Architecture – stage 2: design development

· All engineering disciplines – stage 2: design development

· Interior design

· Catering supply

· Cost estimation

· Architectural renderings

· GoogleEarth 3D polygon renderings

· Proposals for: Visual Impact Assessment, and Water Use Licence Application

· Promotion

· Public relations meetings and management

· Media and marketing presentations and material – Indaba Tourism Show and media articles

· Human Resources

· Bursary programme – in association with African Safari Lodge Foundation, 22 potential staff members were selected from among youth applicants resident in the Malelane area – 12 are under bursary since January 2012 at the SA College for Tourism in Graaff-Reinett, and 10 nature guides are under bursary since April 2012 at the Southern African Wildlife College in Hoedspruit, and will also be provided with field training in the Kruger National Park.

15. Visuals of the Development – Please refer to the plans and visual renderings of the development below.

16. Market Demand – An independent market demand assessment still needs to be conducted, following an assessment carried out by the Company and Carlson Rezidor. Notwithstanding, the Resort will attract a number of different segments:

· The business segment, as a result of the demand for conferencing, together with business people who wish to extend their visit to South Africa by including a trip to the KNP.

· The foreign tourist, attracted to the Resort by virtue of their loyalty to the Radisson Blu brand and as a result of the vast marketing thrust and guest loyalty base that this major international hospitality company is able to offer.

· The domestic tourist, especially the emerging black market, who prefers a fully catered option and an exposure to the wildlife in an open game-viewer with a knowledgeable guide.

· The family tourist who is attracted by the booking of a family room on a repeated basis and who wishes to participate in the activities offered by the resort.

17. As per South African legislation, the Community and BEE component of the business venture is regarded as an essential element which has been:

· Designed to benefit the local Black community who are resident in the direct location of Malelane – defined as within a 70 km radius. The KNP has an established department that deals with the communities situated on its borders and they have been of great assistance in defining the Community villages that fall into the area.

· Structured to include the involvement of Black people and the Community in:

Ownership – At least 30% of the shares will be in the hands of BEE shareholders.

Management – 50% of the Board must comprise Black people, with a strong representation from Black females. In addition, the hotel management will also be substantially Black represented.

Employment opportunities will be offered to local residents, both during the construction and operations phases.

Procurement will be governed by stringent requirements that goods and services are sourced within the local economy.

Social obligations will be fulfilled by the offering of 22 training bursaries in the field of guiding and hospitality. Distributions from the Community Trust will be in the form of contributions in the field of health, education, housing, and environmental awareness programmes.

18. Human Resources – The Resort seeks to directly employ a total of approximately 230permanent staff members across its relevant departments during the operational phase. This excludes the creation of a significant number of indirect jobs that will eventuate from service providers associated with the Resort. The number of jobs created during the construction phase are as yet undetermined. An agreement has been entered in with the African Safari Lodge Foundation, whereby 12 bursary students are in the process of being selected for Hospitality Training at the SACollege for Tourism SA College for Tourism in Graaff-Reinett and a further 10 guides will be provided with bursaries for the South African Wildlife College in Hoedspruit.

19. Green Philosophy – A strong commitment has been made to an environmentally friendly design philosophy for the development. Meaningful steps are being taken to minimize, where feasible, all possible impacts on the development site and surrounding region. The entire professional team is dedicated to green design principles and is mindful of environmental sensitivity in its design approach, as well as its building construction and operational application.

20. Public Relations – as required by the EIA process, Interested and Affected Parties have registered their right to receive information about the status of the project. As a result, a certain faction of the South African society has reacted adversely to the concept of a resort in the Kruger Park and certain media has covered this point of view. However, the majority of the population have different expectations from SANParks and the Kruger National Park, particularly those communities adjacent to KNP. The local community has voiced very positive sentiment and support. SANParks has undertaken a Publicity Campaign justifying their decision and focussing on the significant benefits that will be derived. The influence and positive results of this are starting to become evident.

21. Government Incentives for the business are substantial and comprise the Enterprise Investment Programme for Tourism, administered by the Department of Trade and Industry. This EIP Grant is paid in the form of cash, 50% within 6 months of commencement of the operations and the remainder within 12 months thereafter. The size of investment in the Resort entitles MSRI to claim the full incentive Grant amounting to R 30 million (USD$3.62m). In addition, as a result of the substantial contribution of the venture to the local economy and to job creation in particular, MSRI will also benefit from the further incentives recently announced by the President in the 2011 State of the Nation Address.

22. Outsourced Complementary Businesses – MSRI will focus on the hospitality aspect of the business. There are various peripheral businesses that will be created, among which are:

22.1. Wild Safari Experiences (Pty) Ltd – a company jointly owned by Secprop 118 Investments (Pty) Ltd and Jaco Buys, which will provide guiding services to the resort.

22.2. Safari Vehicle Management (Pty) Ltd – a company that will be owned by Secprop 118 investments (Pty) Ltd and an appropriate business partner and which will own and manage the game drive vehicles used by the Resort. The expected cost of the game viewing vehicles will be R 10.5 million (USD$ 1.27m). This will comprise of twenty-five 10- seater game viewers and two 30-seater game viewers.

- Richprins

- Committee Member

- Posts: 76012

- Joined: Sat May 19, 2012 3:52 pm

- Location: NELSPRUIT

- Contact:

Re: What is the situation/progress with the proposed hotels?

Thanks, Toko!!!

Notice the date of construction has been indicated AGAIN!...Feb 2013

How on earth can they say that with a straight face!?

Notice the date of construction has been indicated AGAIN!...Feb 2013

How on earth can they say that with a straight face!?

Please check Needs Attention pre-booking: https://africawild-forum.com/viewtopic.php?f=322&t=596

- Richprins

- Committee Member

- Posts: 76012

- Joined: Sat May 19, 2012 3:52 pm

- Location: NELSPRUIT

- Contact:

Re: What is the situation/progress with the proposed hotels?

16. Market Demand – An independent market demand assessment still needs to be conducted, following an assessment carried out by the Company and Carlson Rezidor. Notwithstanding, the Resort will attract a number of different segments:

Please check Needs Attention pre-booking: https://africawild-forum.com/viewtopic.php?f=322&t=596

- Richprins

- Committee Member

- Posts: 76012

- Joined: Sat May 19, 2012 3:52 pm

- Location: NELSPRUIT

- Contact:

Re: What is the situation/progress with the proposed hotels?

· The business segment, as a result of the demand for conferencing, together with business people who wish to extend their visit to South Africa by including a trip to the KNP.

· The foreign tourist, attracted to the Resort by virtue of their loyalty to the Radisson Blu brand and as a result of the vast marketing thrust and guest loyalty base that this major international hospitality company is able to offer.

· The domestic tourist, especially the emerging black market, who prefers a fully catered option and an exposure to the wildlife in an open game-viewer with a knowledgeable guide.

· The family tourist who is attracted by the booking of a family room on a repeated basis and who wishes to participate in the activities offered by the resort.

Now the "black diamonds" are relegated quite far down the list? Radisson's loyal customers suddenly above them on the pile! First I've heard of that!

· The foreign tourist, attracted to the Resort by virtue of their loyalty to the Radisson Blu brand and as a result of the vast marketing thrust and guest loyalty base that this major international hospitality company is able to offer.

· The domestic tourist, especially the emerging black market, who prefers a fully catered option and an exposure to the wildlife in an open game-viewer with a knowledgeable guide.

· The family tourist who is attracted by the booking of a family room on a repeated basis and who wishes to participate in the activities offered by the resort.

Now the "black diamonds" are relegated quite far down the list? Radisson's loyal customers suddenly above them on the pile! First I've heard of that!

Please check Needs Attention pre-booking: https://africawild-forum.com/viewtopic.php?f=322&t=596

- Richprins

- Committee Member

- Posts: 76012

- Joined: Sat May 19, 2012 3:52 pm

- Location: NELSPRUIT

- Contact:

Re: What is the situation/progress with the proposed hotels?

It must also be noted that just after this report the developer could not even pay the EIA company, leading to the halt in proceedings mentioned a few pages back!

Please check Needs Attention pre-booking: https://africawild-forum.com/viewtopic.php?f=322&t=596

- Lisbeth

- Site Admin

- Posts: 67456

- Joined: Sat May 19, 2012 12:31 pm

- Country: Switzerland

- Location: Lugano

- Contact:

Re: What is the situation/progress with the proposed hotels?

I never noticed the 40 % investor, but I was always bothered by the only 20% of the Radisson and all the talks centred on them.

Is there any info on who it might be??? I think it is extremely important!!!!

Is there any info on who it might be??? I think it is extremely important!!!!

Probably not a single investor, but a group of individuals/companies and now the question.....Has the sum already been covered or is it still waiting for investors??An investment opportunity therefore exists for an Investor to obtain a minimum 40% shareholding in the project for R 80 million (USD$9.64m). However, a greater equity share can be negotiated should the Investor wish to purchase the Promoters 20% share.

"Education is the most powerful weapon which you can use to change the world." Nelson Mandela

The desire for equality must never exceed the demands of knowledge

The desire for equality must never exceed the demands of knowledge

- H. erectus

- Posts: 5851

- Joined: Fri Jun 01, 2012 6:43 pm

- Country: South Africa

- Contact:

Re: What is the situation/progress with the proposed hotels?

Well Lisbeth hopefully soon your questions will be answered, in

fact should be so. You have a common right, even as a international

supporter, to such info!!

fact should be so. You have a common right, even as a international

supporter, to such info!!

Heh,.. H.e

- Lisbeth

- Site Admin

- Posts: 67456

- Joined: Sat May 19, 2012 12:31 pm

- Country: Switzerland

- Location: Lugano

- Contact:

Re: What is the situation/progress with the proposed hotels?

Article in "Beeld"

Still a long process before the KNP gets hotels.

2012-10-14 21:48

Elise Tempelhoff

The development of the hotel in Malelane in the KNP is more than a year behind schedule.

Much water has to flow into the sea before South Africans will will know of this venture will become a reality. The original plan was to commence construction during October 2011. At this stage the Environmental Impact Assessment still has to be completed.

According to Dereck Milburn the environmental consultant of V&L Landscape Architects it is expected to submit the Scoping Report to the Department of Environmental Affairs during October 2012.

Gerhard Smit the convenor of the AIKONA GROUP commented last week that they are monitoring the process very carefully. He stated that they will oppose the introduction of hotels in the Malelane area and another in the Skukuza rest camp) with great vigour.

He also stated that the MSR is now about 20 months behind the original planned schedule.

The AIKONA GROUP was formed last year by a group of nature lovers who are objecting to the over commercializing and exploitation which includes the hotel development in the KNP..

William Mabasa spokesperson of the KNP said that they hoped that the MSR would materialize sooner but a long process had to be followed. He also stated that no further progress had been made as far as the planned hotel for the Skukuza rest camp is concerned.

Milburn said that all interested parties will be informed once the scoping report had been approved by the Department of Environmental Affairs.

The final Environmental Impact assessment is planned to be completed by March 2013. The DEA should then notify their decision of acceptance/rejection within one month, stakeholders will then have 40 days to submit their comments. Smit commented that the AIKONA will most definitely scrutinize the EIA very carefully.

Milburn stated that should the project now continue without any further delays the cost is expected to be approximately R260 million.

An earlier delay of many months to the process was when the developer of the MSR consortium Mr. Peter Wright, dismissed the previously appointed environmental consultants.

Still a long process before the KNP gets hotels.

2012-10-14 21:48

Elise Tempelhoff

The development of the hotel in Malelane in the KNP is more than a year behind schedule.

Much water has to flow into the sea before South Africans will will know of this venture will become a reality. The original plan was to commence construction during October 2011. At this stage the Environmental Impact Assessment still has to be completed.

According to Dereck Milburn the environmental consultant of V&L Landscape Architects it is expected to submit the Scoping Report to the Department of Environmental Affairs during October 2012.

Gerhard Smit the convenor of the AIKONA GROUP commented last week that they are monitoring the process very carefully. He stated that they will oppose the introduction of hotels in the Malelane area and another in the Skukuza rest camp) with great vigour.

He also stated that the MSR is now about 20 months behind the original planned schedule.

The AIKONA GROUP was formed last year by a group of nature lovers who are objecting to the over commercializing and exploitation which includes the hotel development in the KNP..

William Mabasa spokesperson of the KNP said that they hoped that the MSR would materialize sooner but a long process had to be followed. He also stated that no further progress had been made as far as the planned hotel for the Skukuza rest camp is concerned.

Milburn said that all interested parties will be informed once the scoping report had been approved by the Department of Environmental Affairs.

The final Environmental Impact assessment is planned to be completed by March 2013. The DEA should then notify their decision of acceptance/rejection within one month, stakeholders will then have 40 days to submit their comments. Smit commented that the AIKONA will most definitely scrutinize the EIA very carefully.

Milburn stated that should the project now continue without any further delays the cost is expected to be approximately R260 million.

An earlier delay of many months to the process was when the developer of the MSR consortium Mr. Peter Wright, dismissed the previously appointed environmental consultants.

"Education is the most powerful weapon which you can use to change the world." Nelson Mandela

The desire for equality must never exceed the demands of knowledge

The desire for equality must never exceed the demands of knowledge